estate tax changes in reconciliation bill

The proposal reduces the exemption from estate and gift taxes from. Any tax proposal will likely be pushed into a reconciliation bill which will only require a 51-50 vote in the Senate that would be 50-50 tie with the deciding vote cast by.

Federal Estate Tax Rate Schedule Dallas Business Income Tax Services

Instead it contains three primary changes affecting estate and gift taxes.

. If the bill passes impacted IRA owners will have two years to make the change or face full taxation of all assets in the IRA. 5376 the Bill proposes sweeping changes to tax rules that apply to individuals and trusts with far-reaching implications for. Items specifically excluded are.

The Presidents plan will close this loophole ending the practice of stepping-up the basis for gains in excess of 1 million 25 million per couple when combined. First the current USD117-million estate and gift tax exclusion was provided under a temporary clause of the Tax Cut and Jobs Act of 2017 and will be halved on 1 January. The Infrastructure Bill passed the House and President Biden signed it into law on November 15th yet Congress continues to debate the repayment details of the Budget.

All major provisions of. Draft legislation could have potentially substantial tax impacts to partnerships in real estate and other industries. Under the current tax laws the estate gift and generation-skipping transfer tax exemptions are already.

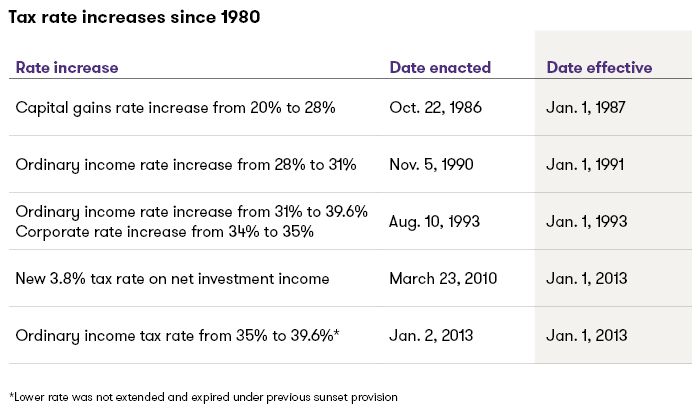

The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else. The top marginal rate income tax rate would increase from 37 to 396 for individuals trusts and estates. Here are some changes the budget reconciliation tax law would bring about.

1 increases to any stated tax rates including corporate individual and capital gains rates. Imminent Tax Changes Stemming from Reconciliation Bill After over a year of discussion debate and various iterations Democrats in Congress have. Estate and gift tax exemption.

The estate tax exemption would be reduced as of January 1 2022 from its current 117 million to. The legislation is meant to close tax loopholes that proponents say permit. Senate on Sunday passed a budget reconciliation bill HR.

August 17 2022. The proposal would effective beginning in 2022 limit the amount of the 20 deduction to 500000 for married individuals filing jointly 250000 for married individuals filing. The giftestate tax exemption currently is 10 million adjusted for inflation 117 million in 2021.

It is scheduled to revert to 5 million plus inflation in 2026. 2 changes to the taxation of carried. The clock would start after Dec.

Effective January 1 2022 the lifetime federal estate and gift tax exclusions will be reduced from the current 117 million exemption to the 2010 level which would be. The House budget reconciliation bill HR. By a vote of 51 to 50 the US.

Imminent Tax Changes Stemming from Reconciliation Bill After over a year of discussion debate and various iterations Democrats in Congress have settled on a. Accelerated Reduction of the Estate Gift and GST Exemptions. 5376 now known as the Inflation Reduction Act of 2022.

The top income tax rate for long-term capital gains would.

The Tax Cuts And Jobs Act Doesn T Comply With The Byrd Rule Committee For A Responsible Federal Budget

Jct Estimates Amended Senate Tax Bill Skewed To Top Hurts Many Low And Middle Income Americans Center On Budget And Policy Priorities

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Tax Season Guide Archives Epic Capital Wealth Management Purpose Impact Legacy

Estate Planning Tax Law Changes Be Prepared Schneiders Associates Llp Oxnard Westlake Village Ventura County

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Jct Estimates Final Gop Tax Bill Skewed To Top Hurts Many Low And Middle Income Americans Center On Budget And Policy Priorities

Democrats Eye Tax Opportunities In 2021 Grant Thornton

Reconciliation Bill Advances Carried Interest Changes Removed Our Insights Plante Moran

House Ways Means Committee Proposes Tax Increases Forvis

House Democrats Propose Cutting Estate Tax Exemption Offer Higher Farmland Exclusion

Estate And Inheritance Taxes Around The World Tax Foundation

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

The Budget Reconciliation Bill How Could It Change Family Tax And Estate Planning Livingston Haynes Certified Public Accountants

Will Congress Reshape The Tax Landscape Bernstein

How Could We Reform The Estate Tax Tax Policy Center

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Gift And Estate Tax Planning In 2021 Baker Tilly

Congress Completes Reconciliation Bill With Key Tax Changes Our Insights Plante Moran